Virtual agents for banking are intelligent systems based on conversational and generative artificial intelligence, designed to interact with customers and operators through natural language, in a fluid, contextual and increasingly human way. Powered by large language models (LLM), these digital agents not only understand complex questions, but are also capable of learning from data and dynamically adapting to new situations and requests.

In detail, virtual agents are able to:

- Understand and respond in natural language: thanks to NLP (Natural Language Processing), they understand intentions, emotions and context, managing multilingual conversations on channels such as banking apps, websites, call centers and even WhatsApp or voicebots.

- Automate repetitive processes: operations such as opening a new account, retrieving credentials, assistance with balance and transactions, card management, reporting fraud or updating personal data can be performed entirely by the virtual agent, reducing waiting times and lightening the load on contact centers.

- Personalize the interaction: virtual agents analyze customer behavior, conversation history and financial data to offer tailored responses, personalized recommendations (e.g. savings or credit plans) and a consistent and proactive experience.

- Integrate with banking IT systems: they connect securely with CRM, core banking, payment platforms, anti-fraud and identity management, facilitating a fluid and interoperable ecosystem. Integration with APIs and RPA tools also allows the activation of fully automated end-to-end processes.

Updated on: June 5th 2025

Estimated reading time: 8 minutes

Table of contents

Virtual Agents for Banking Reduce Investment in Banking Sector

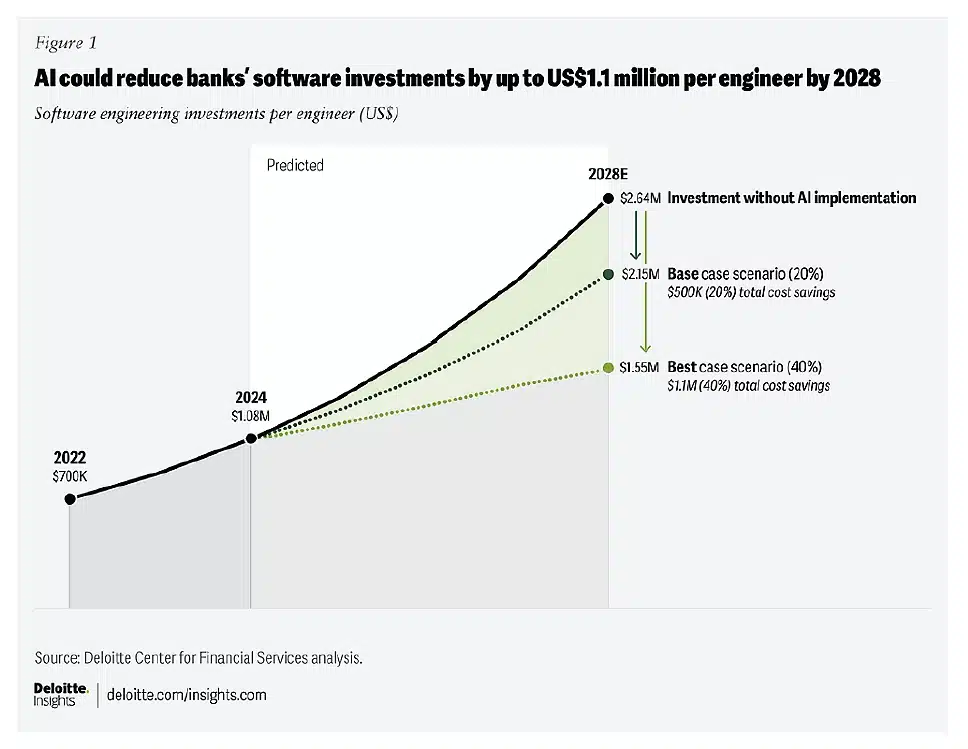

The image below, from the Deloitte Center for Financial Services (2025) report, clearly illustrates the potential impact of AI on reducing software investments in the banking sector. According to Deloitte, banks that effectively adopt AI tools throughout the software development lifecycle – from design to maintenance – could realize significant savings by 2028, up to $1.1 million per engineer.

In detail:

Without AI, the projected investment per engineer in 2028 would increase to $2.64 million.

With a basic AI implementation (20% efficiency), the estimated cost would drop to $2.15 million, generating $500,000 in savings per engineer.

In the best case (40% efficiency), the cost could be reduced to $1.55 million, with a savings of $1.1 million per engineer.

This scenario highlights how AI is not only a tool for technological innovation, but a strategic lever for cost optimization. Banks that invest promptly in AI – particularly in generative AI solutions, virtual agents and intelligent automation – will be able to reinvent their operating model, improving the speed, quality and sustainability of digital development.

Virtual agents for banking are central strategic assets for banks. They are transforming the way financial institutions communicate with their customers, ensuring:

- a faster, more transparent and personalized customer experience

- greater operational security, thanks to biometric recognition, fraud control and intelligent authorization management

- a reduction in operating costs, thanks to the automation of low value-added activities

- and greater resilience and scalability during traffic peaks or in the event of critical events (e.g. cyber attacks, high request flows).

In a scenario where innovation is the new competitive standard, virtual agents represent the bridge between customer care, technological evolution and organizational transformation.

Why Banks Are Focusing on Virtual Agents for Banking

The study published by Deloitte Insights (April 2025) highlights how artificial intelligence – in particular generative models and LLMs (Large Language Models) – is revolutionizing the software development cycle in the banking sector.

84% of developers today use at least one AI assistant to support coding, refactoring, testing or documentation activities. These tools, including GitHub Copilot, IBM watsonx Code Assistant or proprietary solutions, are becoming an integral part of the development toolchains of major global banks.

According to Deloitte, estimated savings for US banks in software development will reach between 20% and 40% by 2028, thanks to the widespread adoption of AI-driven tools. At an individual level, this equates to an average savings of between $500,000 and $1.1 million per developer. These benefits are achieved by accelerating the entire software lifecycle, from design to release.

The areas with the greatest impact

Areas that benefit most from AI include:

- Requirements Analysis: AI agents can identify latent needs, transform briefings into technical requirements, and suggest improvements to original documentation.

- Code Generation: LLMs trained on millions of lines of code automatically suggest or complete entire functional blocks, reducing errors and development time.

- Automated Testing: Tools like Applitools, Functionize, and Testim generate intelligent test cases, learn from the results, and optimize test suites autonomously.

- Continuous Integration and Deployment (CI/CD): AI algorithms optimize release cycles, manage error rollbacks, and improve software stability.

- Predictive Maintenance: AI detects bugs, anomalies, and inefficiencies early, suggesting corrective actions before the problem impacts the end user.

A concrete example comes from Goldman Sachs, which equipped 12,000 developers with AI tools, observing productivity increases between 30% and 55%. Similarly, Citizens Bank recorded a 20% increase in efficiency among engineers involved in a pilot project based on generative AI.

These numbers demonstrate that the adoption of AI is not just a technological choice, but a strategic lever to profoundly renew the way in which banks design, develop and maintain their digital ecosystems.

Benefits of virtual agents for banking

The adoption of AI-based virtual agents offers the banking sector a series of tangible benefits, which go far beyond the simple automation of customer care. Here are the main advantages that are pushing banks to integrate these solutions into their digital ecosystems:

Operational efficiency: fewer errors, faster

One of the most immediate benefits is increased internal efficiency. Virtual agents allow you to:

- manage large volumes of requests in parallel, without waiting times,

- drastically reduce human errors in standardized processes (e.g. customer identification, IBAN recovery, card management),

- automate low-value-added operations, freeing up human resources for more strategic activities.

The result is a significant improvement in response times and service quality, both on the customer side and the back office side.

24/7 Support: Always Available

Virtual agents are always active, without breaks, holidays or office hours. This guarantees:

- continuous customer support, at any time of the day or night,

- immediate management of urgent requests (e.g. card blocking, denied access),

- operational continuity even during unexpected events or traffic peaks.

In an increasingly digital and connected world, 24/7 availability represents a key competitive advantage, especially for customers accustomed to instant interactions.

Reduced costs: intelligent automation

Process automation allows banks to:

- reduce costs related to front-line staffing in contact centers,

- reduce the number of incoming calls thanks to intelligent chatbots that autonomously resolve up to 80% of first-level requests,

- avoid costly errors and rework through automated and traceable procedures.

According to Deloitte, the strategic use of AI – including virtual agents – can contribute to cost reductions of between 20% and 40% in activities related to software development and digital assistance.

Personalized experience: tailored conversations

Thanks to the ability to analyze behavioral, transactional and historical data in real time, virtual agents can:

- adapt the tone and content of the conversation based on the user profile,

- propose relevant products or services, anticipating latent needs,

- recognize the customer on multiple channels, offering a fluid and consistent interaction (omnichannel approach),

- proactively report savings, credit or investment opportunities.

This level of personalization and context improves not only customer satisfaction, but also conversion and cross-selling performance.

How to Successfully Implement Virtual Agents for Banking

Below are five key steps to drive an effective transition to a banking model powered by virtual agents for banking.

- Map inefficiencies to automate

Identify bottlenecks in existing banking processes.

- Build skills and redesign roles

Prepare staff for new AI tools and organizational changes.

- Defining robust and transparent AI governance

Manage risk, bias, privacy and regulatory compliance.

- Integrate strategic partners into the AI ecosystem

Collaborate with technology providers, fintechs and system integrators.

- Measure, Optimize, Scale

Monitor results and continuously improve models and processes.

In conclusion

In conclusion, virtual agents for banking represent much more than a simple technological innovation: they are a strategic lever to redesign the entire banking ecosystem, making it more efficient, accessible and customer-centric. Banks that will be able to intelligently integrate these tools – combining automation, personalization and responsible governance – will be able not only to contain costs and accelerate development, but also to build stronger and more meaningful relationships with their customers. The future of banking has already begun, and it is conversational, predictive and data-driven. Now it is up to banks to choose whether to lead the change or chase it.

Faqs about virtual agents for banking

No, they are designed to work alongside them, freeing up time for higher value activities.

Yes, if integrated with adequate governance and banking security protocols.

On average, a few weeks for the pilot phase; 3-6 months for full operation.

From customer support to internal management, through payments, claims management, fraud, onboarding.

Updated on: June 5th 2025