Banking Chatbots

Revolutionize your customers’ experience with banking chatbots. In an industry where speed, security, and customization make the difference, AI agents for banking represent the new frontier of customer service in the banking sector. Active 24/7, they guide users in real time through banking services, daily operations, and complex requests, offering continuous and always customized assistance.

From checking the balance to dispositive operations such as payments and bank transfers, to personalized support: the virtual assistant is always ready to respond.

Automation

Provide a customer self care automation service

EFFICIENCY

They help reduce customer service costs.

Personal banking

They provide personalized responses and savings and investment suggestions based on your user profile.

Conversational Banking Use Case

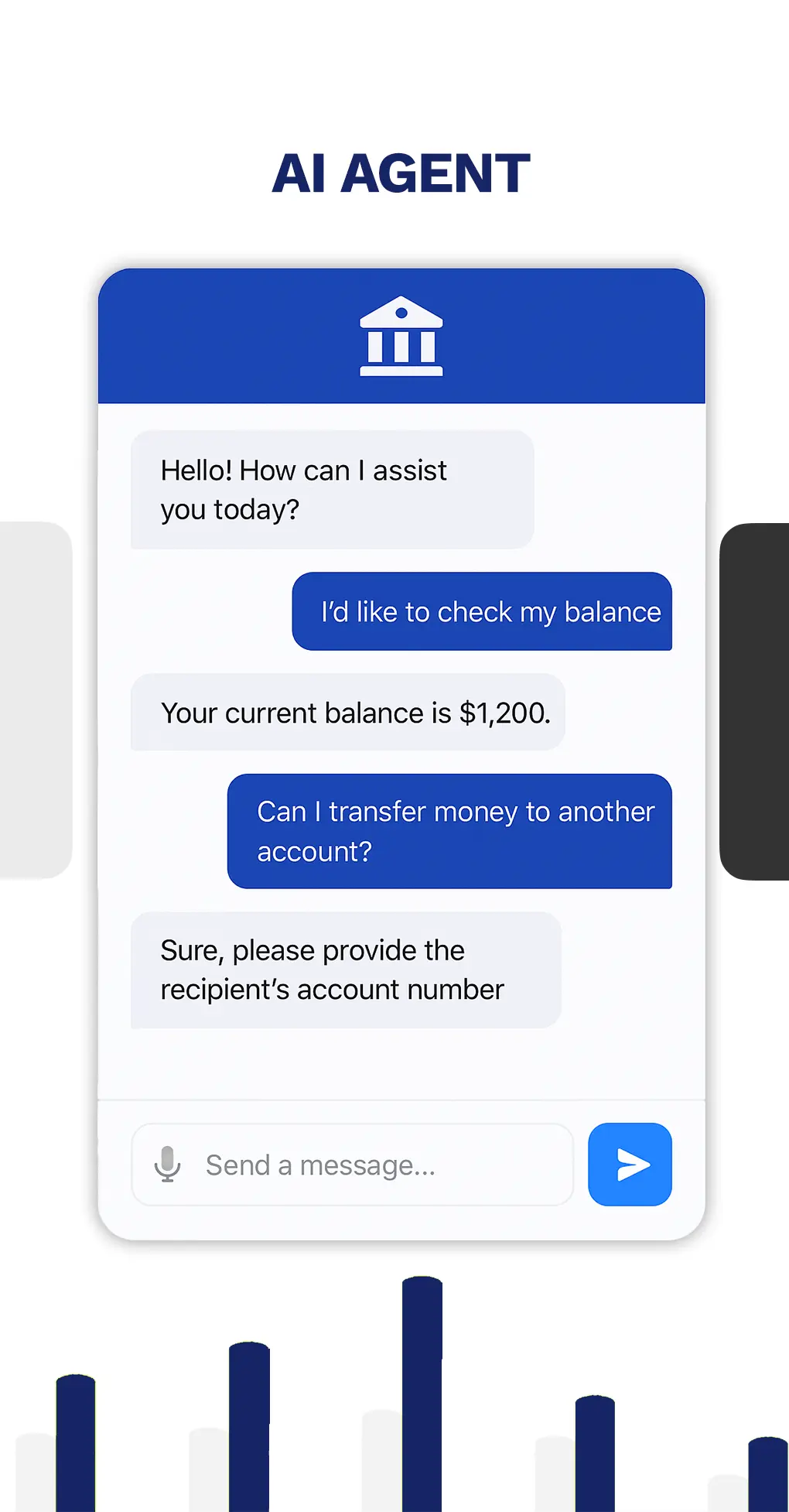

AI Agents

A study conducted by Ulster University has developed and tested banking chatbots that can answer frequently asked questions (such as balance, movements or transactions), book appointments, support currency conversion and guarantee secure access via two-factor authentication.

The advantages that emerged are many:

Accessibility and immediacy: the user can manage their account with a simple voice or text request

Reduction of the load on contact centers: the chatbot absorbs the most common requests, freeing up human resources for higher-value activities

Personalization and continuity: the bot is able to maintain the context of conversations, improving the fluidity and naturalness of the interaction

Creating banking chatbots

Punctual and personalized assistance

People are increasingly interacting with systems through voice assistants and chatbots. Industries such as banking and finance are adopting these technologies to create more responsive customer services.

Crafter.ai offers an advanced platform for creating banking chatbots, paying particular attention to reliability and security aspects.

Crafter.ai allows the integration of chatbots with existing bank systems (ERP, CRM, CMS) through secure APIs. This allows for seamless communication between the chatbot and internal infrastructures, while maintaining high security standards.

The LLM technology within the Crafter.ai platform allows you to create and manage the knowledge base to support interactions to ensure reliable and accurate responses on every channel.

The RAG document management system allows you to integrate documents into the knowledge base and limit the chatbot’s response perimeter.

Through the handover module integrated into the platform, it is possible to transfer the conversation to an operator if necessary.

Analytics & Safe Interactions

Conversation data helps you better understand customer interactions and continuously improve the effectiveness of your service, such as identifying frequent conversation flows, pain points, and emerging user needs.

The platform enables downloading of conversational insights reports to enable banks to gain a deeper understanding of customer interactions, improve service quality, and ensure secure and compliant data management.

Banking Chatbots

Panoramica delle applicazioni

24/7 Assistance

Assistance with account access, reporting a lost card, and checking transactions.

Fraud Prevention

They monitor transactions in real time to identify suspicious activity, flagging potential fraud risks.

Process automation

They simplify and automate complex processes such as applying for loans, managing investments, and opening accounts.

Finance education

They support customers’ choices with information and answers as a financial education tool.

Personal banking

Tailored financial advice, helping users make informed decisions based on their spending habits and goals.

Analytics & Feedback

They collect and analyze data on customer interactions, providing valuable insights to improve the services offered.

Banking Chatbots Numbers

Building Customer Loyalty with AI

The integration of artificial intelligence and conversational assistance in banking chatbots opens up personalization and loyalty scenarios that were unthinkable until a few years ago.

The global market for AI agents for banking, finance and insurance (BFSI) sector is expected to reach 7 billion dollars by 2030.

This data confirms the growing impact of these digital solutions in the financial world, a trend that will continue to strengthen thanks to continuous advances in artificial intelligence and machine learning.

At the same time, customer habits and expectations are also evolving: according to a report by Everfi, 53% of users have already changed their primary financial institution and a further 9% are considering doing so.

In such a dynamic context, banks must adapt quickly and offer experiences aligned with new needs if they want to maintain the trust and loyalty of their customers.

%

Banking interactions that will be automated by Chatbots

%

Improving operational efficiency in financial institutions with AI

%

Financial Institutions Using AI Agents for Customer Experience

About us

OUR CUSTOMERS

The innovation entrusted to Athics, with the development of a virtual assistant, allows us to guarantee a rapid and qualified flow of information transfer, give precise answers that enhance the experience of our customers and draw on conversation analytics data, which we can use to improve our services.

Insights

“The technological revolution forces banks to reinvent their business and operating models”.

Accenture – Global Banking Consumer Study

Finance Chatbots for customer relationship banking

Finance chatbots are no longer just tools designed to automate standard responses to common customer questions. Today, they are evolving into true “relationship accelerators” between financial institutions and their users. While in the past they were primarily seen as solutions to reduce wait times and quickly handle simple requests, modern finance chatbots—powered by artificial intelligence and conversational assistance—can now create more engaging, personalized, and interactive experiences, establishing a deeper and more direct connection between banks and customers.

Virtual agents for banking

With virtual assistants, banks can establish a “one to one” dialogue with customers and support them in managing ordinary banking activities and have data through which to improve their services and propose new products, with the constant aim of providing users with a personalized approach and increasing the conversion rate.