Insurance Chatbots

Insurance chatbots allow you to build a completely automated and personalized customer journey: from policy search to underwriting, up to claims management.

They represent a concrete response to the need for insurance companies to be reactive, efficient and close to people, without increasing operating costs.

They allow you to manage requests in real time, offer 24/7 support, simplify the underwriting and management of policies, reduce the times in claims processes.

The result? An experience that makes every customer feel unique and listened to, strengthening loyalty and reducing the risk of churn.

Automation

They handle volumes of frequent requests.

EFFICIENCY

They streamline processes and activities.

Personalization

They analyze user data to offer tailored policies, increasing conversion’s opportunities.

Chatbot for insurance agencies

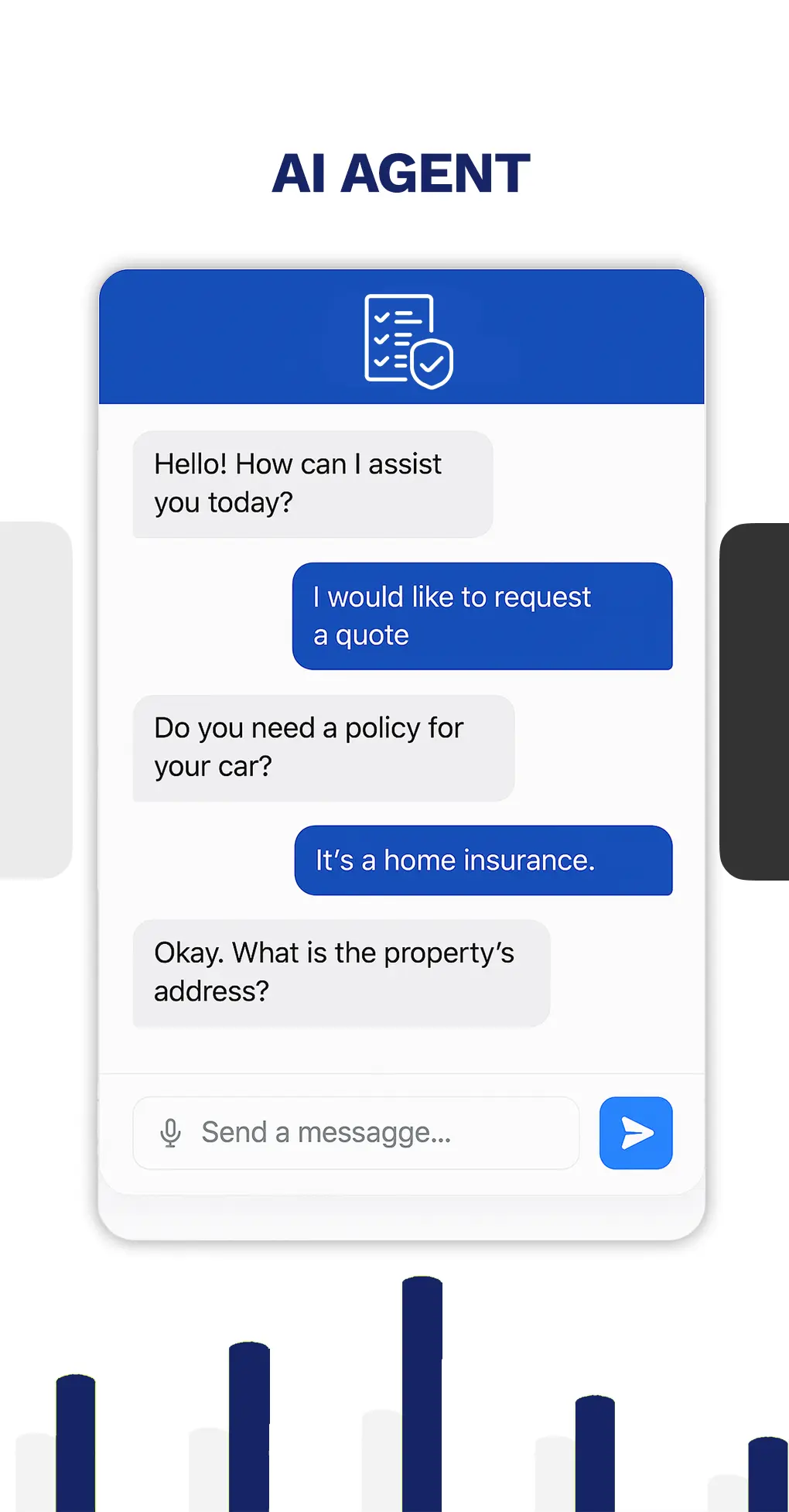

AI Agents use case

Insurance Chatbots enable a self-care insurance model, offering a simple, immediate and always available experience.

The chatbot guides the user in collecting the necessary information, facilitates the process of reporting and managing claims, verifies the policy coverage in real time and can even open a case autonomously, drastically reducing waiting times and friction in the customer journey.

Thanks to automation, the chatbot takes care of low-added-value activities, such as providing answers to frequently asked questions, sending updates on the status of the case or collecting documentation, thus lightening the load of human operators who can focus on more complex and high-impact cases.

The result is a smoother and more efficient process, with more satisfied customers thanks to the speed and simplicity of interaction, and a positive impact on operating costs, which are reduced thanks to the digitalization and scalability of the service.

How to create Insurance Chatbots

Conversational AI for Insurance

To be competitive, insurance companies must understand how to effectively support their customers while keeping costs low. With Crafter.ai it is possible to create Insurance Chatbots that can manage information and dispositive activities, such as support for the subscription of a contract, the collection of customer data, the acquisition and forwarding of practices, the sending of notifications and reminders of policy expirations, etc. Chatbots can be integrated with company ERP, CMS and CRM systems via API, facilitating the direct entry of collected data. This ensures that information is updated and accessible in company systems, improving operational efficiency.

Crafter.ai uses RAG (Retrieval-Augmented Generation) and LLM (Large Language Models) technologies to integrate documents into the knowledge base of AI agents. This allows chatbots to extract relevant information from unstructured documents, improving the accuracy of responses. Finally, the handover module integrated into the platform allows you to maintain control over conversations and transfer specific cases to an operator if necessary.

Analytics & Report

The platform allows you to download conversational insights reports, giving insurance companies a deep understanding of customer conversations. This allows them to improve service quality, personalize responses, and ensure secure and compliant data management, while adhering to privacy and security regulations.

Insurance Chatbots

Application Overview

Customer Assistance

Insurance chatbots provide instant assistance and answers to frequently asked questions from customers.

Quotes calculation

They collect customer information to prepare customized quotes, comparing different policy options.

Renewals and reminders

They send timely notifications about policy expirations, making the renewal process easier.

Claim processing

They guide customers through the claims process, and provide real-time updates on requests.

Subscription support

They collect the information for risk assessment, validate the documents, facilitate the forms filling out.

Customer onboarding

Information about insurance products, explaining complex terms and helping you understand your needs.

Insurance Chatbots Numbers

Personalization & Self-Service

The insurance market is undergoing a profound transformation, driven by the growth of the self-service segment and the demand for personalized digital experiences. New generations, especially Millennials, prefer to purchase services independently, when and where they want, with a simple and intuitive interface. According to Capgemini, the annual growth rate of the self-service insurance market is set to increase by 21% by 2029.

To remain competitive, insurers must respond to this evolution by integrating advanced conversational solutions, such as insurance chatbots.

%

Insurance Customers at Risk of Churn Due to Lack of Digital Assistance

%

Estimated Growth of Self-Service Insurance by 2029 (CAPGEMINI)

%

Insurance leaders looking to increase the level of automation

About us

Our customers

The integration of the Conversational AI solution developed in collaboration with Athics has transformed our customer care service. Thanks to the chatbot’s ability to autonomously manage frequent requests and direct customers to personalized solutions, we have been able to improve operational efficiency and customer satisfaction.

Insights

“In recent years, the insurance sector has undergone a rapid digital transformation, based on the personalization of the insurance offer”. McKinsey – Global Insurance Report

HOW TO EMPLOY AI IN INSURANCE

Bringing AI to insurance means improving the customer journey and customer satisfaction in a sector that is struggling to meet today’s expectations in terms of customer experience. Always focused on risk management and customer protection, the insurance world is now at the crossroads between operational efficiency, innovation and a new centrality in services to citizens and businesses. Artificial intelligence in insurance is the engine of this transformation.

AI to support the insurance sector

In the insurance sector, risk management through automation and data aggregation technologies will be essential to predict market behaviors and the actions to be taken for better organizational agility and resilience, to promote cost reduction, on the one hand, and to anticipate needs and risk profiles on the other.

Chatbots for insurance

According to an IBM research, 95% of insurance company executives intend to invest in AI, while companies in the sector that have already done so benefit from a competitive advantage in terms of customer care, communication and in general in business activities.